Are you looking for a way to manage your investments in a transparent, legally secure and comprehensible manner? The investment management software otris corporate offers a central platform for up-to-date, consistent information, improves the efficiency of your investment management and enables standardised reporting.

![]() Centralised data storage enables all authorised users to access company data quickly and independently of their location.

Centralised data storage enables all authorised users to access company data quickly and independently of their location.

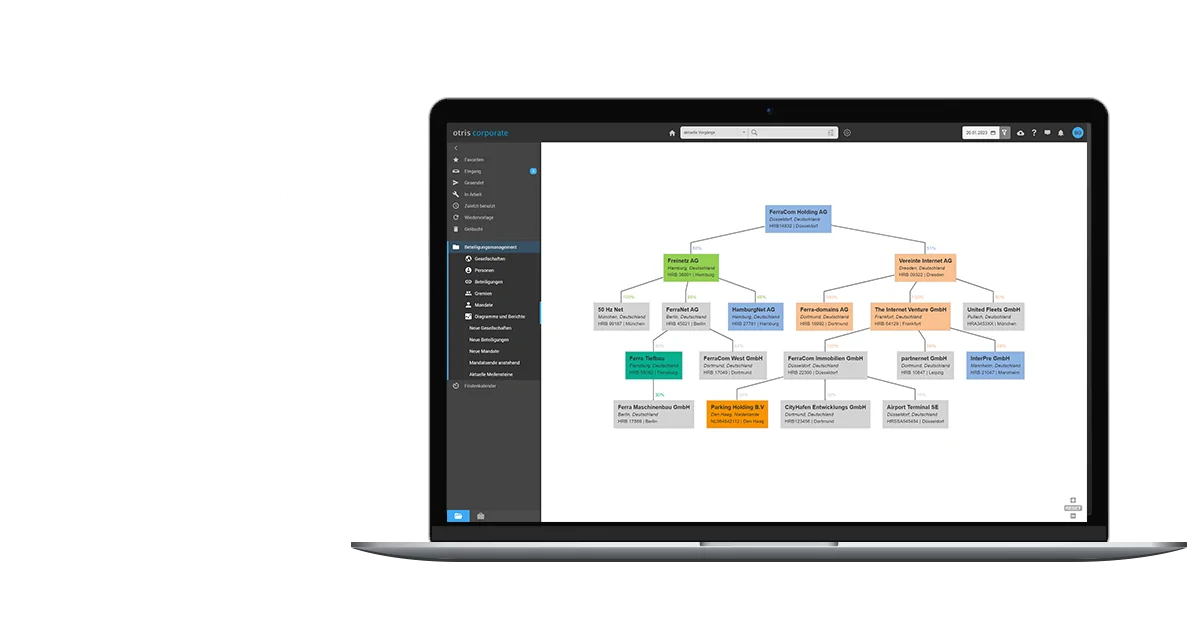

![]() Organisational graphs and structured data improve understanding and transparency of the corporate structure.

Organisational graphs and structured data improve understanding and transparency of the corporate structure.

![]() Customised reports support decision-making and facilitate communication with internal and external partners.

Customised reports support decision-making and facilitate communication with internal and external partners.

Overview of our investment management software

otris corporate has a modular structure. You can combine basic elements, such as the central company file, with extensions. If needed, we can integrate your company-specific workflows into the application. The goal: a solution that precisely meets your requirements.

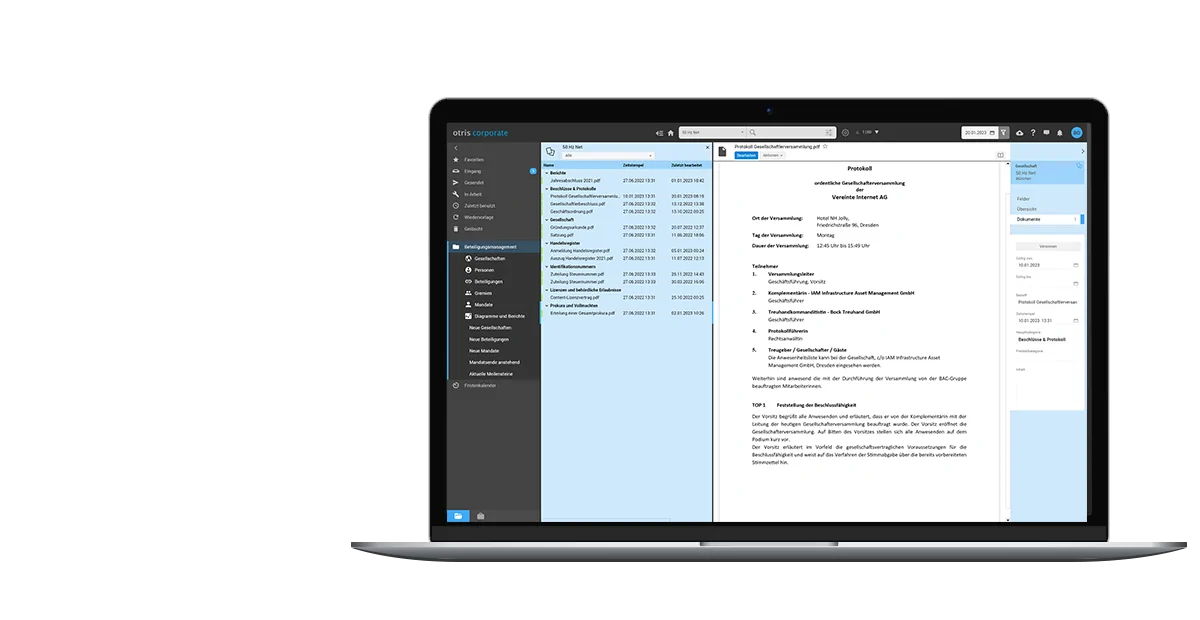

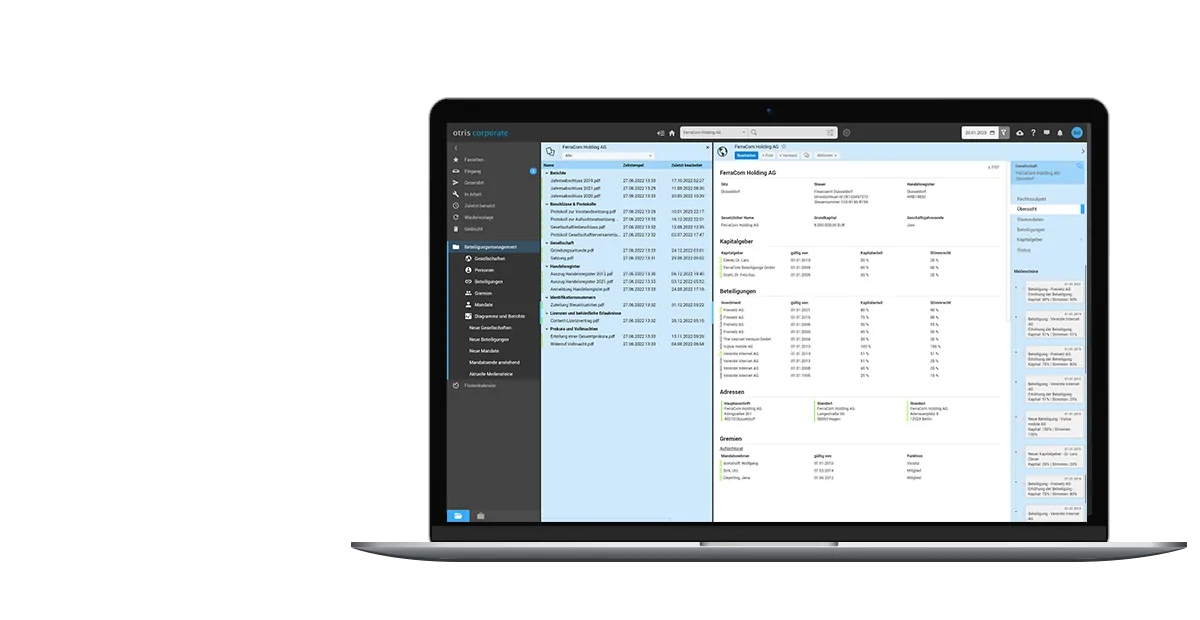

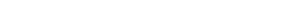

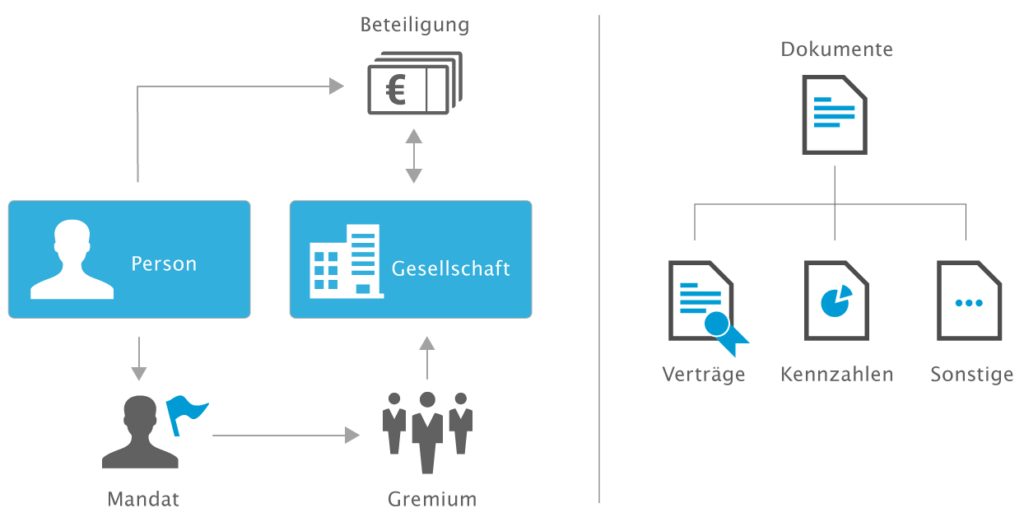

Central database | Company files

You can use the group’s central database to manage the corporate records of all investments, including master data, performance indicators and investment amounts. Additional information/documents can be added easily. The investment documentation is linked to the companies, investments and mandates. Comprehensive search and filter functions simplify research.

Board and mandate administration

Clearly display all boards with their current members and view past appointments. Manage related documents (e.g. resolutions, meeting minutes) and use the appointment organiser with deadline warnings. Links to individual mandate holders clarify which persons hold which positions in the group of companies.

Visualised structures

Investment management software enables transparency with the help of various visualisations: these illustrate the structure of the investment structure and provide you with a complete overview of the links and dependencies between the companies. The graphical representations and interactive diagrams summarise the essential information and simplify navigation.

Terms and deadlines

The integrated deadline monitoring feature minimises risks by monitoring expiring contracts, appointments to boards or upcoming audits and meetings, and sending e-mail reminders to the responsible groups of people in good time. A deadline and appointment calendar provides the necessary overview. If employees do not respond to warnings, a predefined workflow determines the escalation path.

Authorisations | Access

The authorisation concept ensures that access is only possible for a certain group of people. otris corporate integrates all content into a differentiated authorisation and access concept with clear rules and possible exceptions. The implementation is always individual and tailor-made: from a pragmatic approach to complex access control.

Reporting | Controlling

The integrated business intelligence solution processes relevant investment management data in reports that you can access in common output formats and diagram types. You can add further indicators to standardised performance indicators. The investment management software automatically sends regular reports by e-mail to freely definable distribution groups.

otris corporate

Our investment management software otris corporate centrally manages and clearly links all important master data and performance indicators of the individual companies as well as their investments, investors, mandates and boards. All data and documents are historicised on a key date-related basis when saved, so that you always have access to the current structure at any desired date in the past.

Why you should rely on the investment management provider otris

Those who are familiar with the complex, daily challenges of investment management know how important it is to have reliable software that meets the company’s needs. That’s why you should rely on an experienced investment management provider like otris, who will work with you to develop the ideal solution.

The following features characterise our investment management software:

Usability. Simple and intuitive.

User-friendliness is the main focus in the development of all otris solutions. The excellent usability of the Investment management software simplifies navigation and the recognition of connections. The interactive organisational graph can be customised with just a few clicks so that you can view it from the desired perspective (e.g. from the perspective of a specific investment). Links take you to further information with just one click (example: the name of a member of the supervisory board is linked to the master data created about him or her).

Integration. Smooth and platform-independent.

As a browser-based application, otris corporate does not require any local installation on the users’ computers. The investment management solution integrates into your IT infrastructure, regardless of which IT systems you work with. If necessary, you can use standardised interfaces to connect existing software solutions, thus enabling a bidirectional data exchange.

Range of Functions. Standard Software Can Be Customised.

Companies can customise the range of functions of the investment management solution according to their requirements. To do this, they choose one of the three software editions, which they can combine with extensions if necessary. If there are further requirements that are not covered by the standard range of functions, otris Consulting can implement customisations to meet these needs. The solution’s architecture is designed to be so open that adaptations can be implemented with a manageable amount of effort. The possibilities range from simple data field additions to complex interfaces to third-party systems.

Operating form. On-premises or cloud.

You can choose whether you want to operate your investment management software as a cloud solution or on-premises. If you decide on the otris cloud, you access the servers of a secure data centre (located in Germany). With the on-premises operating form, you use your own company’s IT infrastructure. With both operating forms, the user accesses the software via a web browser.

Scalability. Expandable as needed.

The scope of the investment management system adapts to your needs. For example, you can start with the basic version and gradually expand the system with additional functions. And not only the range of functions, but also the number of users can be quickly and easily adapted.

Another option is to start with a SaaS solution in the otris cloud that can be cancelled at any time. Once you are satisfied that the system is working for you, you can switch to your own company server at any time. When you switch from the cloud to your own company server, all system settings, configurations, data, documents and processes are transferred. Of course, the same applies the other way around – when switching from an on-premises solution to the otris cloud.

Data security. Your data in the otris cloud.

The otris cloud meets the highest data security requirements: ISO 27001-certified high-security data centres in Germany, modern encryption algorithms and GDPR compliance, as well as recurring IT security audits and penetration tests, ensure security in the otris cloud.

Data quality. The basis for important decisions.

Consistent process orientation and customisable workflows ensure high data quality: the information status of all participants is up-to-date and uniform. Data can be searched for in a targeted manner and is quickly available.

Historisation. Understanding development.

The key date-related historisation of all data and documents makes changes and version statuses traceable at any time. With the push of a button, you can reset the entire application to any point in time: This makes otris corporate your personal simulator for investment and participation history.

Security. Managing risks.

As the investment structure grows, so does the number of terms and due dates. Financial years that end at different times for each investment, regular supervisory board meetings or upcoming reporting requirements – with otris corporate, you can keep both an overview and control.

You decide where your data is stored: either in your own IT environment or with us in the otris cloud. You also define an authorisation system that grants or denies users access to individual pieces of content.

Services. There for you.

Whether you need a standard system or a large-scale project, we meet the diverse needs of companies. We offer you customised services from consulting and planning to the implementation of your investment management solution. After the project is completed, you can choose from a variety of service level agreements (SLA) if needed.

Which investment management edition suits your requirements?

To provide you with the solution that best suits your company-specific requirements, we offer a choice of three editions and functional extensions:

STANDARD

Digital investment management solution for all company-related documents and data. Historised master data on companies, persons and investments. Standardised processes for terms, authorisations and reports.

Advantages

- Quickly ready to start

- No IT resource commitment

- No high initial investment

- SaaS solution

SaaS from

490€ / month

ENTERPRISE

Can be customised to company-specific requirements and processes. Extended functionality and standardised interfaces.

In addition to STANDARD

- Financial data and reports

- E-file/document tree

- Extended authorisation concept

- Callback programming possible

- SaaS or on-premises

SaaS from

990€ / month

ENTERPRISE plus

Can be customised to meet company-specific requirements, processes and interfaces. Standardised technical concept plus customisable data schema.

Additional to STANDARD and ENTERPRISE.

- Additional workflows and file types for further business processes

- Custom programming possible

- SaaS or on-premises

On request

€ / month

Modules for our investment management software

With modules, you can customise otris corporate even further to meet your individual needs. All extensions are compatible with each of the three editions.

Office Drop. E-mail features and Office integration.

With Office Drop, you can document and archive e-mail correspondence directly and easily from Microsoft Outlook or other Microsoft Office applications. The plugin connects Microsoft applications with your otris corporate solution. You can use the plugin to select the company file to which you want to assign e-mails, for example. The contents (text, subject, sender, attachments) are automatically inserted by otris corporate into the structure of the digital company file. The result is a complete history with all correspondence. You can also access the investment management system from applications like Microsoft Word or Excel and send documents directly to the target file without having to open otris corporate.

The Office integration is bidirectional. With Office Drop, you can not only transfer data from an Office application to otris corporate, but also the other way around. For example, if you want to attach a document from otris corporate to an e-mail in Outlook, you access otris corporate via the plug-in, select the document and attach it to the e-mail. With the additional desktop component, you can import files from your drives into otris corporate using drag and drop.

Signature. Digital signature.

The signature interface enables the digital signing of documents in otris corporate according to the procedures of the connected signature platforms (e.g. DocuSign, FP Sign). Documents created in otris corporate (e.g. draft contracts) are sent to the signature service provider at the push of a button. This creates an electronically signable version of the document. The recipient receives the document for review/signing and is notified by email. After the signature, otris corporate assigns the document to the corresponding file and updates the status.

You can get the licence for the signature interface from otris software AG. You can purchase licences for the signature service directly from the signature service provider of your choice.

Creator. Template and Clause Library.

The Creator module supports the creation of contracts, corporate documents, and other legal documents. The Creator combines a template library with a clause library. The templates are created in a predefined corporate design by selecting the desired clauses. To create a contract draft from the templates, for example, the user first selects the parameters belonging to the template (Duration, Subject Matter, etc.). The creator inserts the selected parameters into the predefined places in the contract and creates the draft contract. The system automatically documents which clauses were used in which contracts/documents.

Connector. Interface management. (unidirectional)

Der Connector ist eine Schnittstelle, die Fremdsysteme mit otris corporate verbindet. Der Connector ruft Gesellschafts-, Debitoren- oder Kreditorendaten z.B. aus einem ERP-System ab und legt diese bei Bedarf in otris corporate an. Neben diesem speziellen Connector kann die Software auch an beliebige Drittsysteme angebunden werden. Der Connector verarbeitet eine Vielzahl von Datenformaten und stellt eine Konfigurationsoberfläche zur Verfügung. Hier erfolgt die Anbindung der Datenquelle sowie die Zuordnung (“Mapping”) der Daten zu den Feldern der Anwendung und die Definition der Importregeln.

Archive. Audit-proof Archive.

The Archive module enables audit-proof archiving and chronological snapshots of documents. Different versions, including the associated documents, attachments, remarks, notes or e-mails, are ‘frozen’.

The archive component is certified by KPMG according to IDW PS 880 and fulfils the requirements of commercial and tax law. These include the generally accepted accounting principles (GoB), the generally accepted principles of computer-based accounting systems (GoBS), the principles of data access and verifiability of digital documents (GDPdU) and the Federal Data Protection Act. An authorisation concept for active archiving and access to archived documents can be set up individually. By using open interfaces, the expansion to a comprehensive archive can also be used for data from third-party solutions. Communication with third-party solutions can optionally be done at the push of a button, through actions in workflows or automated – for example, controlled by a predefined status change.

App Extended. Mobile investment management.

The App Extended add-on makes the myCorporate app configurable and unlocks the full range of functions for mobile investment management. In addition to the advantage of transferring documents and processes that can be used offline to your mobile device, you also benefit from the option of carrying out actions: approvals, forwards or comments can be made via the app. The preconfigured app maps a classic investment management scenario. If necessary, you can make adjustments, extensions or changes to the preconfigured functions and authorisation structures independently and without programming knowledge in the admin area.

Combine otris corporate according to your needs.

In addition to investment management, the otris legal SUITE includes further specialised solutions (contract management, process management and protection rights management), all of which are aimed at making the legal processes in your company more efficient.

For further information on our specialised solutions and combination options, please do not hesitate to contact us.

Our software for investment management in practice

otris corporate supports you in managing your investments. Four practical examples:

Standardised administration.

A company acquires another. The additional investment should be integrated into the existing structure.

otris corporate simplifies the takeover process: Data and documents for all investments are stored in digital investment files. Creating a new investment file in otris corporate and integrating it into the organisational graph is straightforward: The predefined file structure simplifies the systematic compilation of all necessary documents.

Efficient reporting.

Every year, the company has to create a K-3 report with detailed information on foreign investments and send it to the Bundesbank. If there is a large number of investments abroad, collecting the data is time-consuming.

otris corporate generates K-3 reports in the XML format required by the Bundesbank at the push of a button. The system checks which investments meet the K-3 criteria and transfers the required data into a report. If the data of all investments is maintained in otris corporate, you can create the annual K-3 report in just a few minutes.

Overview of the organisation of the board.

A meeting of the supervisory board is coming up. The board must be invited in good time and informed about the agenda in its current composition.

otris corporate informs the employee responsible for committee organisation about the upcoming meeting. The employee can find the contact details of the committee members in the system – from there, they can send the invitation to the supervisory board meeting and attach the relevant documents (e.g. the agenda or the minutes from the last meeting) to the email. The system logs the sent invitation and automatically assigns the email to the corresponding digital file.

Information for audits.

A tax audit requires data on the 2018 investment structure. Without technical support, reconstructing this data can be time-consuming.

otris corporate integrates a ‘time machine’. The system displays the state of the investment structure on a freely selectable date. The historicised view allows for quick compilation of the information. Alternatively, you can give the tax audit a time-limited access to the system. The auditors can then independently access the data and documents they need.

News

Case studies | Articles

Try out the investment management software otris corporate now!

Are you looking for investment management software that impresses with its clear structures, transparency and user-friendliness? We invite you to get to know otris corporate in a free demo version. Increase the effectiveness of your investment management – from detailed data collection and visualisation to term and access control. Contact us for more information!

Online demo | Register now for free!

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More InformationFAQs: Frequently asked questions about investment management software

What is investment management?

Investment management controls and monitors all corporate investments. An investment manager also takes care of relevant information on the investments, provides this information in both a current and retrospective manner, organises shareholder meetings, supports Investment controlling processes and Investment strategy, and often also coordinates the preparation of annual financial statements.

Why is investment management important?

As a central service unit, investment management enables efficient, legally compliant and economically sensible control of investees. The main objective is to promote the organisational purpose and to comply with all relevant legal and corporate regulations.

What advantages does otris corporate offer?

otris corporate offers a central data platform and thus increases the transparency and efficiency of your investment management. In addition, investment structures can be mapped at any historical point in time. Furthermore, the software can be extensively customised and thus adapted to your company’s workflow.

To what extent can otris corporate be customised?

otris corporate has a modular structure and can therefore be precisely tailored to your company-specific needs. You decide which functions you need.